MAC Prices Hit LTC Sites Hard: Margin Loss Seen

“Things had been going smoothly with our accounts, and we understood what we were billing and being paid,” he recalled in an interview with Specialty Pharmacy Continuum. “But then a year or so ago, we began to notice that our margins were shrinking.”

Dr. Warnock and his team considered—and eliminated—the usual suspects: increasing costs of labor, goods, packaging or operations. They assumed it must be a problem with inventory; perhaps inventory managers weren’t buying correctly. “But as we got deeper in, we realized it was something we hadn’t seen before.”

The team finally was able to identify the culprit when they began looking at their Medicare Part D billing. They found that the drug costs specified by the Centers for Medicare & Medicaid Services (CMS) “was not what our drug costs actually were,” Dr. Warnock said. “The MAC [Maximum Allowable Cost] prices were off dramatically for extended periods of time. We found a pattern: Generic drug prices would go up, but the MACs would not reflect that. It got to the point where every time we dispensed a generic drug, we were losing money, and the spreads kept getting larger.”

As an increasing proportion of Pruitt’s prescriptions moved to generic, the situation became a “perfect storm” of getting paid less and less, more and more frequently.

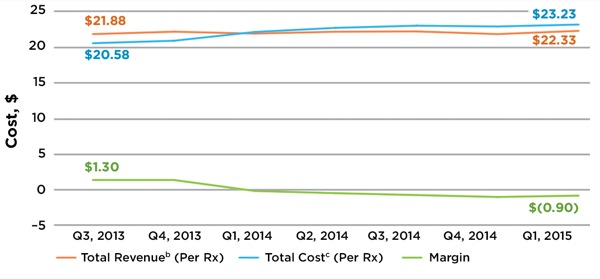

It turned out that Pruitt wasn’t alone. An Avalere analysis released in November, based on data from 18 LTC pharmacies—including some 21.4 million individual drug transactions from January 2012 to March 2015—found that MAC prices paid for the same generic drug on the same day by different payors can vary considerably. Generic drugs reimbursed using MAC pricing now have negative margins, the analysis concluded, because revenue has remained flat even as total cost has increased. Sometime around the first quarter of 2014, the analysis found, the curves crossed: Average total revenue for all generic drugs reimbursed using MAC pricing dipped below the average total cost, and stayed there. By the first quarter of 2015, average total revenue per drug was $22.33, vs. an average total cost—cost of goods plus a fixed $13.54 for cost to dispense—of $23.23, for a negative margin of 90 cents per 30-day prescription (Figure).

CMS has established additional MAC transparency requirements, effective Jan. 1. The new standards require pharmacy benefits managers (PBMs) to update MAC prices on a frequent basis in the Medicare Part D program—although other federal health care programs, such as Tricare, are not included. However, a coalition of LTC pharmacies called the Senior Care Pharmacy Coalition (SCPC), which sponsored the Avalere study, thinks the CMS measure will not be enough.

“These new requirements do not go far enough to ensure that independent LTC pharmacies know what they’ll be paid, and the market-based reasons for pricing changes,” Alan Rosenbloom, the president and CEO of SCPC, told Specialty Pharmacy Continuum. The problem, he noted, is that transparency in and of itself might be insufficient to create a fair negotiating playing field between independent LTC pharmacies and PBMs, because it does not necessarily lead to any actual change in pricing policies or practices.

Long-term care pharmacies are not alone in dealing with MAC pricing challenges, but Mr. Rosenbloom said they face unique additional burdens that community-based pharmacies do not. “Additional regulatory requirements in these settings mean that packaging must be in a unit dose and individual to the patient, in a way that can be easily dispensed. The average nursing home patient takes seven or eight prescriptions in any given day, and 11 or 12 over the course of a month. The amount of medication and management requirements, and consultative clinical services, make the cost to dispense significantly higher than in the retail setting—about 30% to 35%.”

Plus, LTC pharmacies don’t have the same offsets as community retail pharmacies. “For the most part, they have no other real sources of revenue—no sales of convenience items directly to consumers, for example,” Mr. Rosenbloom said. “MAC pricing variability, unpredictability and apparent disconnect from true market conditions make the situation even worse for independent LTC pharmacies.”

Long-term care pharmacies aren’t opposed to MAC pricing, Dr. Warnock said. “We understand why MAC pricing is important. It makes us better and more conscientious purchasers. We’re not after a competitive advantage; we just want fairness. A universal MAC would be fine with us; a fair and open process for determining MAC would be fine with us; even understanding the process would be fine with us. We’re fine with competing, but just let us compete.”

Click here to see the original article on the Specialty Pharmacy Continuum website.

Recent Posts

-

Senior Care Pharmacy Coalition Welcomes New Vice President of Strategy and Government Affairs

The Senior Care Pharmacy Coalition (SCPC), the leading voice for the nation’s long-term care (LTC) pharmacy community, announced today the hiring of Shara Selonick (formerly Shara Siegel) as Vice President of Strategy and Government Affairs. Selonick will work closely with the organization’s leadership and board of directors to drive advocacy and policy initiatives on behalf of the LTC pharmacy sector.

-

SCPC Comments on 2028 IPAY Draft Guidance

June 25, 2025 The Honorable Chris KlompDeputy Administrator and Director of the Center for MedicareCenters for Medicare & Medicaid ServicesDepartment of Health and Human Services7500 Security BoulevardBaltimore, MD 21244 Re: Medicare Drug Price Negotiation Program Draft Guidance Dear Deputy Administrator Klomp: On behalf of the Senior Care Pharmacy Coalition (SCPC), we write to comment on […]

-

SCPC Urges Congress to Include LTC Pharmacy Fix in Reconciliation Package to Save Prescription Drug Access for Seniors in Long-Term Care

The Senior Care Pharmacy Coalition (SCPC), the leading national voice for the long-term care (LTC) pharmacy community, released the following statement regarding the reconciliation package passed by the House Energy and Commerce Committee on May 14.

Stay in the Know

Get the latest news and updates on issues impacting the long-term pharmacy community.