Senate bill aims to protect taxpayers from costly drugs

Roll Call

One proposed change to Medicare prescription drug benefit is to help the program control costs it absorbs to keep premiums stable. (CQ Roll Call file photo)

Congress this year could enact the biggest overhaul of Medicare’s prescription drug benefit since it was first established in 2003. If successful, seniors — and taxpayers — would be more insulated against the cost of the most expensive drugs.

One proposed change is meant to help Medicare control the costs it absorbs so that the program’s premiums can remain stable despite increasing drug prices. Supporters of the drug program tout its low premiums, with the Trump administration and the private insurers who run Part D recently highlighting that average consumer premiums will fall in 2020.

But the program’s overall costs are rising, and is subsidized mostly by taxpayers, who pick up the highest drug costs. One little-discussed trend is that this federal support is the fastest-growing part of the $80 billion drug program.

The amount the government paid to subsidize the highest-cost individuals represented 25 percent of Part D spending in 2007, but 54 percent in 2017, according to the Senate Finance Committee, which is leading the charge to overhaul the program.

House and Senate draft bills would cut Medicare spending by changing the financing for the highest-cost seniors. To save the government money, the private plans that Medicare pays to administer the program would take on more financial risk, and drugmakers would have to provide discounts.

It’s possible that the proposed changes could end up having consequences of their own, such as insurers restricting drug access to control costs, and drug companies investing less in research.

The proposed changes reflect the fact that drugs are more expensive than when the Medicare drug benefit was first enacted. Under the current system, Medicare pays 80 percent of annual costs over $8,140. Rising drug prices have led to more seniors reaching that level.

“The original design would probably still be adequate if drugs cost what they cost 10 or 15 years ago, and that’s obviously not the case,” said Juliette Cubanski, associate director of the Kaiser Family Foundation’s program on Medicare policy. “Congress, I think, is now trying to catch up to the present-day reality that we’re all facing, in terms of the high cost of some medications, and benefit design that’s not totally in step with that reality.”

Reasons for the rise in high-cost patients

Medicare Part D, signed into law when Republicans controlled the White House and both chambers of Congress, was designed to be run by private companies, unlike the original Medicare fee-for-service program that covers hospital stays and doctor visits.

Part D’s private insurers take on some financial risk. But most of the costs are paid for by Medicare.

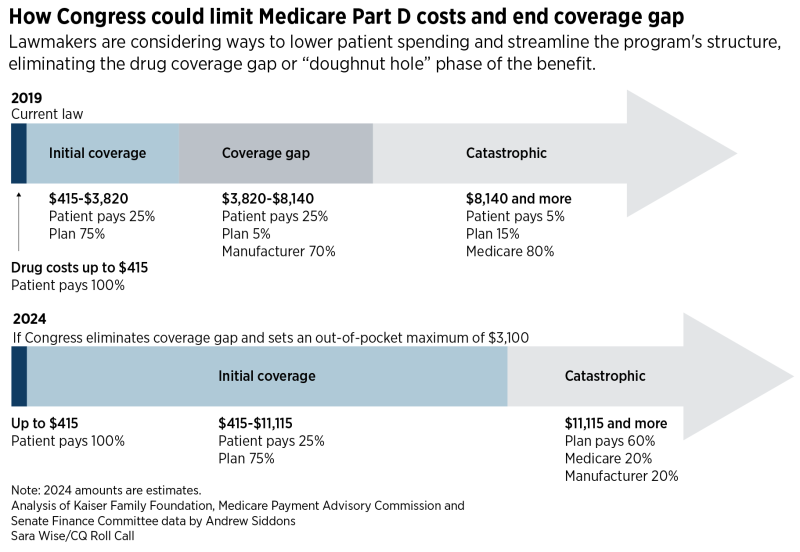

Congress is considering changing who pays what as drug spending hits certain thresholds. The Finance bill would streamline the current complicated structure of the drug benefit, which splits costs between patients, insurers, drugmakers and taxpayers. The division of costs shifts when certain spending levels are reached.

Rising drug prices in recent years mean it is more likely for seniors to reach the “catastrophic” phase where Medicare covers 80 percent of costs. For instance, the Hepatitis C treatment Harvoni, which cost Medicare $2.5 billion in 2017, is $78,000 per patient during a one- or two-month course — which essentially puts someone into catastrophic coverage immediately.

The number of people who reached this threshold with a single prescription was 33,000 in 2010. That increased to 360,000 by 2016, according to the Medicare Payment Advisory Commission.

Other factors may have made the problem more acute. Two changes occurred as part of the 2010 health care law.

When the program was originally designed, for budget reasons, Congress created a coverage gap or “doughnut hole.” When individuals reached a certain amount of spending, they were on the hook for the full costs of their drugs until they reached the level where the catastrophic coverage kicks in.

The health law closed the doughnut hole. Part of the change required brand-name drugmakers to offer discounts for seniors in the gap, which changed over time and grew to 70 percent this year. But the law also required the discounts to count along with the patients’ out-of-pocket expenses. In other words, a senior would reach the catastrophic spending amount while technically paying less than that.

“The coverage gap phaseout has been helpful for beneficiaries in terms of lowering their out-of-pocket costs, but it’s been sort of detrimental for the program overall from its spending perspective in terms of increasing Medicare’s and taxpayers’ liability for those really high-cost medications,” Cubanski said.

The Senate Finance Committee’s description of its bill argues “that insurers’ limited liability for drug spending during the coverage gap and catastrophic coverage phases of the benefit reduces their financial incentive to steer utilization toward the lowest cost drugs.”

The insurance industry denies that it has any incentive to push seniors to the catastrophic phase, where its 15 percent share can still be quite costly.

Tara O’Neill Hayes, deputy director of health care policy at the free-market think tank American Action Forum, said the problems were hard to predict at the time they were made, but said “it speaks to the problems of short-sighted and piecemeal legislating.”

“When you add all of these things up, they are acting with each other to cause even greater impacts than they might each on their own,” she said.

Potential impact of proposal

Lawmakers are now trying to diminish the perverse incentives for drugmakers and insurers by shifting the amount Medicare pays in the catastrophic phase from 80 percent to 20 percent by 2024.

Under the proposal, the health plans’ share would increase from 15 percent to 60 percent over that time. The drugmakers would provide a 20 percent discount.

The thinking behind the changes is that they will discourage drugmakers from jacking up prices and encourage insurers to be better stewards of their beneficiaries’ drug costs and prioritize lower-cost therapies over more expensive ones. The Congressional Budget Office estimated that the changes would save the government $34.6 billion over a decade.

Patients would benefit because they will no longer have to pay anything once they spend $3,100 on drugs in a year. Under the current system, seniors pay 5 percent of costs above the catastrophic level.

The Finance panel said CBO estimated that seniors would save $20 billion because of lower cost-sharing, and premiums would drop by $6 billion between that and other proposed changes.

The savings for the government and seniors could require some tradeoffs, however.

If the government pays less and seniors pay less, more of the burden will fall on drugmakers in the form of discounts or a lack of price increases they might have taken otherwise, CBO director Phillip Swagel said at the Finance Committee markup last month.

While most lawmakers doubt the drug industry’s apocalyptic claims of threats to innovation, it seems unlikely that the change would have no effect on their future investment decisions, said Hayes of the American Action Forum.

The plan is also intended to influence health insurer behavior, but insurers could respond in a way that bothers patients.

Insurers often control costs by limiting access to expensive drugs. They can require insurer approval before they are prescribed, which is known as prior authorization, or require that patients start on cheaper drugs and only move on to pricier treatments if that isn’t effective, which is known as step therapy.

While patients worry about high prices, policies that result in restricted access like that can be deeply unpopular.

“You can’t have it all,” Cubanski said. “You can’t have open-ended access to medications and expect that you are also going to have costs under control.”

Recent Posts

-

Senior Care Pharmacy Coalition Welcomes New Vice President of Strategy and Government Affairs

The Senior Care Pharmacy Coalition (SCPC), the leading voice for the nation’s long-term care (LTC) pharmacy community, announced today the hiring of Shara Selonick (formerly Shara Siegel) as Vice President of Strategy and Government Affairs. Selonick will work closely with the organization’s leadership and board of directors to drive advocacy and policy initiatives on behalf of the LTC pharmacy sector.

-

SCPC Comments on 2028 IPAY Draft Guidance

June 25, 2025 The Honorable Chris KlompDeputy Administrator and Director of the Center for MedicareCenters for Medicare & Medicaid ServicesDepartment of Health and Human Services7500 Security BoulevardBaltimore, MD 21244 Re: Medicare Drug Price Negotiation Program Draft Guidance Dear Deputy Administrator Klomp: On behalf of the Senior Care Pharmacy Coalition (SCPC), we write to comment on […]

-

SCPC Urges Congress to Include LTC Pharmacy Fix in Reconciliation Package to Save Prescription Drug Access for Seniors in Long-Term Care

The Senior Care Pharmacy Coalition (SCPC), the leading national voice for the long-term care (LTC) pharmacy community, released the following statement regarding the reconciliation package passed by the House Energy and Commerce Committee on May 14.

Stay in the Know

Get the latest news and updates on issues impacting the long-term pharmacy community.